The pandemic’s second wave has appeared in Europe and now in the U.S. The Fed is more concerned about the economy and has taken the unprecedented step of telling Congress it will monetize whatever spending Congress desires. (Not your Father’s Fed!)

The latest weekly unemployment data confirm the Fed’s worst fears: The Recovery has stalled!

Overview

No matter who wins the election, the following issues must be faced:

- Deflationary forces are at play. The pandemic is ongoing (clearly, the second wave is upon us), with no “control” in sight. Even if the virus is brought under “control,” consumer behavior will not return to pre-pandemic status anytime in the foreseeable future. The pandemic has changed the consumer’s psyche. Some parts of the (new) economy will grow, but, on the net, the forces of lower demand due to unemployment will keep inflation in check for the foreseeable future;

- Even after the pandemic subsides, there will be slower GDP growth due to demographic factors. This was already occurring with the post-Great Recession recovery being the slowest in the post-WWII era. It has to do with the aging demographics in developed countries. A policy can do little to change demographics;

- Leverage (debt) is at unprecedented levels (both public and private). Besides unthinkable (at least a year ago) federal debt, corporate debt is at record levels with the Fed continuing to support “zombie” corporations with, until February, was unimaginable monetary policy. While credit card and other revolving debt has fallen to $756 billion from over $1 trillion due to the consumer’s newfound frugality, student debt has ballooned to $1.67 trillion. This will reduce the new labor force entrants’ consumption patterns (unless such obligation is “forgiven”).

A Fed Like No Other

The Fed’s September minutes were released the week of October 4, and, in them, we find heightened concerns about the state of the economy. The following passage is from the minutes (emphasis added):

While the risk of another broad economic shutdown was seen as having receded, participants remained concerned about the possibility of additional virus outbreaks that could undermine the recovery. Such scenarios could result in increases in bankruptcies and defaults, put stress on the financial system, and lead to disruptions in the flow of credit to households and businesses. Most participants raised the concern that financial support for households, businesses, and state and local governments might not provide sufficient relief to these sectors.

The virus has found new legs, as recent cases have ballooned all over Western Europe and most U.S. states (34 at last count).

It appears that the Fed’s concerns about increases in bankruptcies and defaults and stress in the financial system (from the minutes: “…delinquency rates on business loans had risen noticeably”) are beginning to come to fruition. Look in particular at the part of the passage from the Fed minutes that I emboldened. Besides this passage, in recent oral remarks, Fed Chair Powell said: “The recovery will be stronger and move faster if monetary policy and fiscal policy continue to work side by side…” (emphasis added).

I used the word “Scary” in the title of this blog. I have been following the Fed and its policies for my entire business career (50+ years). I wrote my doctoral dissertation about how Fed policy impacts equity prices (still applies today). This is the first time, ever, that I have seen them (both Chair and FOMC members) try to influence fiscal policy.

Remember when Trump criticized the Fed in 2018-19 for raising interest rates? At that time, the entire set of Fed officers and FOMC members were distraught and indignant that he would seek to influence them. After all, the Fed was intended to be “independent” of the political process. Why is it now ok for the Fed to use its influence to move fiscal policy, or even be on one side of the budgetary debate? Remember, Fed officials are not elected, so playing in the political process may be dangerous to that concept of “independence.”

Monetization

The upshot of all of this is that this Fed has admitted to monetizing the Treasury’s debt. Powell has clearly stated that the Fed would be buyers of any additional debt Congress chose to issue (thus keeping rates low no matter how much new Treasury debt is issued).

- The framers of the 1913 Federal Reserve Act explicitly stated that the Fed could not “monetize” the Treasury’s debt. As a result, the Fed is prohibited from purchasing debt directly from the Treasury. To get around this, the Fed uses the Wall St. Banks, which buy the debt at the auction, and then put it up for sale. The Fed then buys it (and Wall St. Makes a profit!). However, this is the first time that we have ever heard a Fed official, much less the Chair, talk to Congress about working “hand in hand.”

- The framers of the 1913 Act put that provision in because a runaway deficit ultimately leads to a weak currency (beware: the potential loss of reserve currency status for the dollar!) and, eventually, to runaway inflation.

- As an aside and while I am on the Fed’s case: How did 2% become the inflation goal? Pre-Great Recession, stable prices meant 0% inflation. (In fact, in the mid-1990s, when asked at a Congressional hearing what inflation should be, then-Fed Chair Alan Greenspan said “0%!”). There is not now, nor has there ever been a body of academic studies indicating that 2% is an appropriate inflation target. There are no Fed white papers on this topic. Where did it come from? Apparently, from Bernanke, when he was Fed Chair.

- In any event, this is a signal to the financial markets that there is no end in sight to the Fed’s “monetization” of the debt or the double-digit percentage expansion of the money supply. This,t along with the large Biden lead in all the latest polls (Wall St. sees more massive deficits, more spending, therefore more monetization if Binden wins), has given a lift to equity prices of late, even while the real underlying economy continues to falter.

The Economy and Employment

Employment has been and remains the key to the state of the economy. The chart below shows the rise in “permanent” job losers. (Fed minutes: “The participants judged it as less likely for future job gains to continue at their recent pace because a greater share of the remaining layoffs might become permanent.”). Remember, at the beginning of the pandemic and during the initial business shutdowns, most of the layoffs were seen as “temporary.” But, as the realization has set in that the return to “normal” is anything but imminent, that word “temporary” has morphed into “permanent.” The latest data point on the St. Louis Fed chart (see below) shows 3.8 million permanent job losses. Look at what happened to this statistic in the Great Recession period. If history is any guide, it appears that we are in the early stages of the shift to “permanent” from “temporary.” In my view, this data is destined to get worse, much worse, before it gets better.

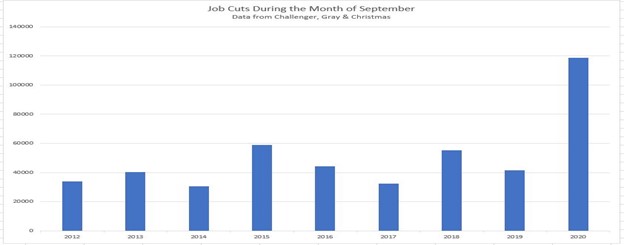

Challenger, Gray, and Christmas

Another sign of deterioration in employment comes from the employment placement firm, Challenger, Gray, and Christmas. The chart below shows that September layoffs were more than double the “normal” September layoff activity. This is especially concerning because it is another indication of a stalled economy.

State and PUA Data

The data for state Initial Claims (ICs) is shown in the table and chart below. Note how these new layoffs have maintained at or above 800,000 since early August (nine weeks in a row) after having fallen pretty consistently from their April peak. Again, these are new claims which parallel further layoffs. When the Pandemic Unemployment Assistance ( PUA) ICs are added in, there was an unfathomable 1.26 million new unemployment claims the week ended October 3. (And that didn’t include the new layoff announcements from Disney or the airlines.) Besides recent layoffs, state unemployment data show 10.6 million Continuing Claims (CCs) and 25.6 million when the PUA program is added in.).

Now for the kicker: This technical note accompanied the weekly Department of Labor (DOL) news release of state and PUA unemployment data on Thursday, October 8:

In response to recommendations resulting from an internal review of state operations, the state of California has announced a two-week pause in its processing of initial claims for unemployment insurance benefits. The government will use this time to reduce its claims processing backlog and implement fraud prevention technology. Recognizing that the pause will likely result in significant week-to-week swings in initial claims for California and the nation unrelated to any changes in economic conditions, California’s initial claims published in the UI Claims News Release will reflect the level reported during the last week before the pause.

Amid all the uncertainty, even the data releases have become unreliable!

Fed Conclusions

- The pandemic isn’t going away, and a return to “normal” is nowhere in sight;

- The Fed is worried about the faltering economy so much so that it has publicly promised to monetize any debt Congress creates, thus straying from their 107-year role as “independent” from the fiscal process;

- Wall Street loves this because it promises excess liquidity (“The Fed has our back”) and equity prices have once again responded;

- Because the employment numbers continue to show a stalled (stalling) economy, there appears to be no end in sight for Fed largesse.

Hudson Job Search is Here for You

Please fill out our contact form if you want to register for our next Zoom meeting or are unemployed and need a one-on-one advisor for help. We are here for you!